Nothing for home buyers in Budget 2019

Friday, February 22, 2019

BC Budget 2019, tabled on February 19, 2019 by Finance Minister Carole James, offers nothing to help home buyers – whether they’re first-timers or trading up.

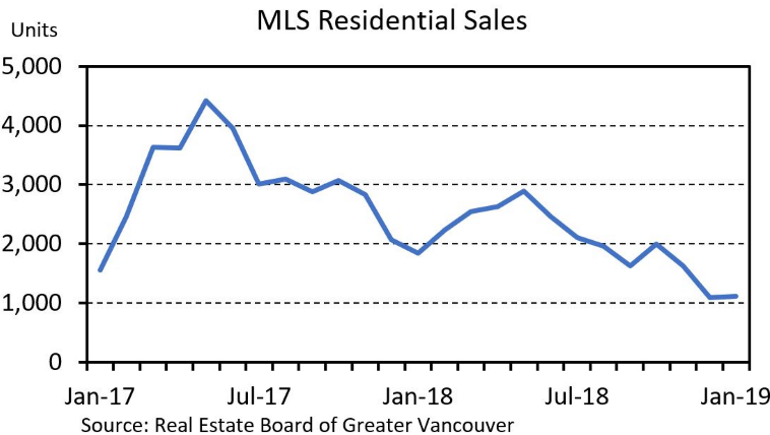

The government is forecasting Property Transfer Tax (PTT) revenue to remain at $1.910 billion, despite a significant slowdown in home sales and housing starts.

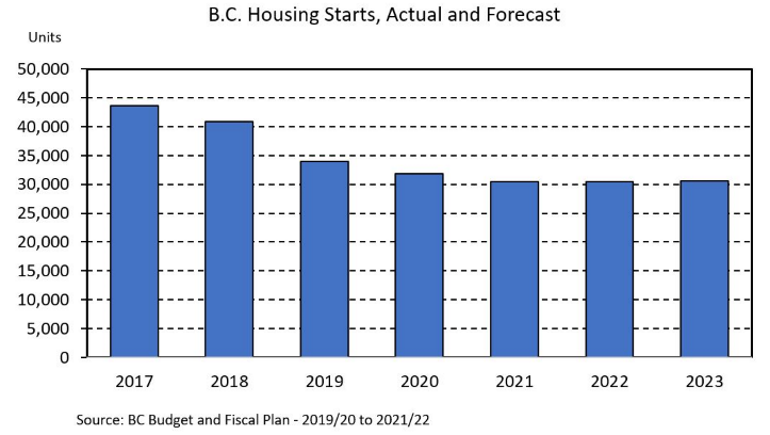

Housing starts

Housing starts fell 6.4 per cent in 2018 and are forecast to drop 16.7 per cent to 34,000 units in 2019 from 40,857 units in 2018 and 43,664 in 2017. Starts are forecast to decline even further to 30,517 units in 2021.

The Speculation and Vacancy Tax

- Forecast to bring in $87 million in 2018/2019 and $185 million in each of the three fiscal years following.

The Real Estate Board of Greater Vancouver recommendations

- increase the First-Time Home Buyers’ Program PTT exemption threshold to $750,000 from $500,000.

- increase the 1% PTT threshold to $525,000 from $200,000 for all home buyers.

- index PTT thresholds using the consumer price index, and make adjustments annually for the:

- 2% and 3% thresholds;

- First-Time Home Buyers’ Program exemption threshold; and

- Newly Built Home Exemption threshold.

- expand the exemption for the additional 20% foreign buyers’ PTT to include everyone with a work permit in BC, and don’t increase this tax or expand it beyond its current geographical scope.

The government did not implement any of these recommendations.

Other Budget highlights

Anti-money laundering

- $6 million for Anti-money laundering, cannabis legislation and gun and gang violence.

Speculation and Vacancy Tax – retroactive to November 27, 2018:

- There’s an exemption for property that's uninhabitable due to a natural disaster or a hazardous condition for at least 60 days.

Renters

- Funding to community organizations to operate rent banks to help tenants in danger of losing their homes.

- Funding for short-term loans with low/no interest to low-income tenants in financial crisis who can’t pay rent.

Although the government promised to introduce a $400 annual renters’ rebate, this is missing from this budget.

CleanBC

- Additional funding of $679 million for the CleanBC plan includes $58 million to make homes/ buildings more energy efficient. This covers rebates up to $14,000 for energy efficiency home improvements and $700 for high-efficiency natural gas furnaces. Rebates up to $6,000 apply to new zero-emission vehicles.

Read

Budget 2019 Highlights (opens 8-page pdf)

Full BC Budget and Fiscal Plan Document (opens 143-page pdf)

CleanBC Backgrounder (opens 4-page pdf)

BC Child Opportunity Benefit Backgrounder (opens 2-page pdf)